Are you a homeowner feeling weighed down by multiple high-interest debts? A home equity loan could be the key to consolidating your finances and saving you significant money. In this article, we’ll explore the world of home equity loans – their benefits, drawbacks, and how they compare to other options like Home Equity Lines of Credit (HELOCs).

What is a Home Equity Loan?

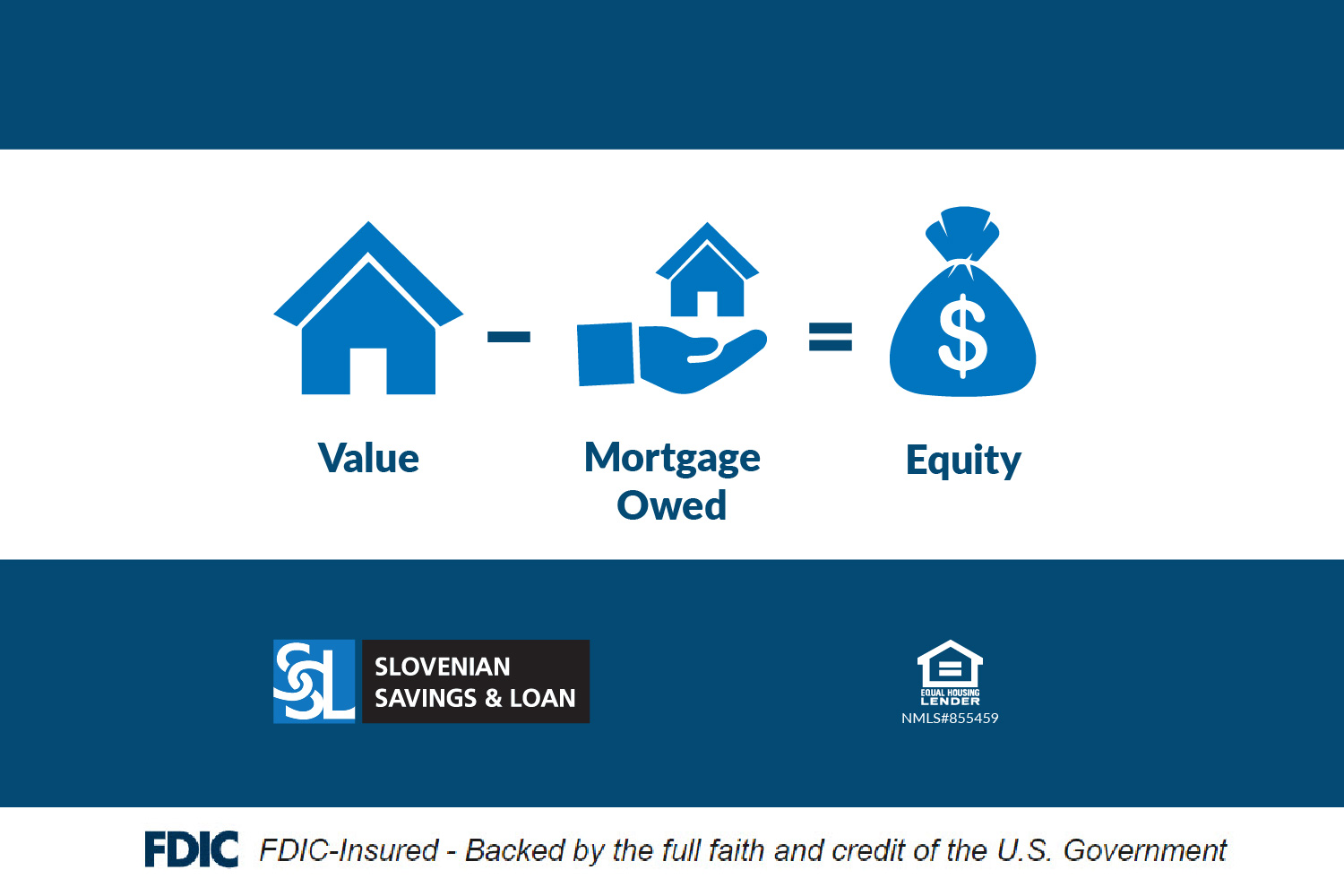

A home equity loan allows you to borrow against the equity you’ve built up in your home. Equity is the difference between your home’s current market value and the outstanding balance on your mortgage. Home equity loans provide a lump sum of money at a fixed interest rate, which you repay over a set period, typically 1-15 years.

Benefits of Home Equity Loans:

- Debt Consolidation: By combining multiple high-interest debts into a single, lower-interest home equity loan, you can dramatically reduce the amount you pay each month in interest, potentially saving you thousands over the life of the loan.

- Lower Interest Rates: Compared to credit cards and other unsecured loans, home equity loans typically offer significantly lower interest rates due to the security of your home as collateral.

- Potential Tax Deductions: In many cases, the interest paid on a home equity loan used for home improvements or eligible debt consolidation may be tax-deductible, further reducing overall costs. (Consult a tax professional for details.)

- Improved Credit Score: Making consistent, on-time payments on a home equity loan can have a positive impact on your credit score over time.

Home equity loans can consolidate high-interest debt into one lower-interest payment, potentially saving money, offering lower rates, and tax deductions, while also helping improve your credit score with timely payments.

Drawbacks of Home Equity Loans:

- Risk of Foreclosure: If you default on the loan, you risk losing your home, as it serves as collateral for the debt.

- Closing Costs: Expect to pay various fees associated with originating the loan, such as appraisal, application, and other closing costs.

- Temptation to Overspend: Access to a lump sum of cash can make it tempting to overspend, so it’s crucial to use the funds responsibly and for their intended purpose.

Borrowers face the risk of foreclosure, closing costs, and the temptation to overspend with a lump sum, making it essential to manage funds responsibly.

Home Equity Loans vs. HELOCs

While both home equity loans and HELOCs use your home’s equity as collateral, there are some key differences:

| Feature | Home Equity Loan | HELOC |

| Structure | Fixed-rate, fixed-term loan | Revolving line of credit with variable interest rates |

| Flexibility | One-time lump sum disbursement | Ability to access funds as needed |

| Interest Rates | Typically lower fixed rates | May have lower initial rates, but can fluctuate over time |

A Home Equity Loan provides a fixed-rate lump sum, while a HELOC offers a flexible, revolving line of credit with variable interest rates.

Choosing the Right Option

When deciding between a home equity loan or a HELOC, consider the following factors:

- Purpose of the Loan: Is it for a one-time expense like debt consolidation or home improvements, or ongoing, variable expenses like education costs?

- Interest Rate Preferences: Do you prefer the stability of a fixed rate or the potential savings of a variable rate?

- Financial Discipline: Can you responsibly manage a revolving line of credit, or would a fixed loan payment better suit your needs?

Consider the loan’s purpose, your preference for fixed or variable interest rates, and your ability to manage either a revolving credit line or fixed payments when choosing between options.

Don’t know where to start? We can help!

If you’re a homeowner considering a home equity loan, contact Slovenian Savings & Loan. You don’t need to be an existing customer! Our friendly loan officers will discuss your options and help you determine if a home equity loan is the right move for you. Remember, using your home equity responsibly can be a powerful tool for debt consolidation, home improvement, and achieving your financial goals.