A) Nice try, but… – You try to balance your checkbook using pencil and paper, but find it frustrating and have difficulty making the numbers agree.

B) See No Evil – You avoid the frustration altogether by 1) Ignoring your monthly statement altogether, 2) Using the bank’s balance, or 3) Keeping an approximation in your head.

This brochure will help simplify the balancing process and hopefully reduce the anxiety level when your bank statement arrives, or when you check your balance online.

Seldom will your bank statement and checkbook register agree. But, that is no reason to panic. It’s merely a matter of timing.

Your statement lists the transactions posted to or cleared to your account as of the closing date. The closing date is usually found in the upper righthand corner of the first page of your statement.

Once your statement has closed, it will take a few days for the information to be printed and for it to arrive in the mail. Meanwhile, you are continuing to write checks, make ATM withdrawals and/or deposits, and hopefully, keeping track of these transactions in your checkbook register.

Remember, it also takes a few days for your checks, ATM, Visa Check Card, and/or deposit transactions to be recorded on your account.

Recording each transaction in your checkbook register and adding or subtracting it from the balance is the first step to simplifying the balancing act.

It’s important to record the transaction at the time you actually write the check, make a withdrawal, or make a deposit.

By recording the transactions and balancing your account total in your checkbook register, you’ll get a clearer picture of your spending habits and know exactly how much money you have. And, if for some reason you detect a problem, the sooner you can correct it, the better.

Balancing your checkbook each month within a day or two of receiving your statement will not only reduce your stress level, it will lessen the amount of time it takes to complete the task.

On the back of your monthly statement is a handy form to help you balance. Use it along with the following steps to make balancing a snap.

Before you begin, gather the following:

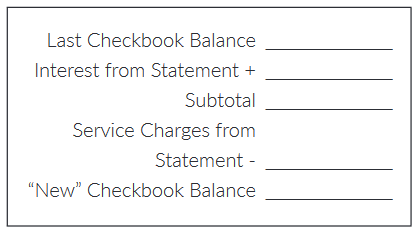

In your checkbook register, enter all of the interest earned on your account (if applicable). The interest earned will appear on the front of your statement.

Add this balance. Be sure to record any other credit amounts listed, such as bank corrections.

In your checkbook register, record any charges that have been subtracted from your account, as shown on your statement.

In your checkbook register, record any charges that have been subtracted from your account, as shown on your statement.

These charges may include:

Subtract these charges from your register balance.

Look at your latest statement and verify that all deposits listed match the deposit amounts listed in your checkbook register.

Look at your latest statement and verify that all deposits listed match the deposit amounts listed in your checkbook register.

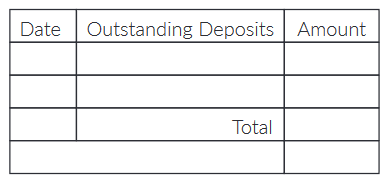

Make a list of any deposits that are listed in your register but do not appear on your statement. Add these together.

Tip: Use the worksheet on the back of your statement.

Match the entries in your register with the transactions listed on your bank statement. Compare check numbers, dates, and dollar amounts on all checks written. If these items match, place a check “P” mark next to the transaction in both your register and on the bank statement.

If they don’t match, circle the item in both places so that you can come back to fix the error once all of the transactions have been checked off.

Check for one of three errors:

Be sure that all of the outstanding items from your previous statements have been included in this statement. Otherwise, they are still outstanding.

Note: If an item is outstanding for 60 days or more, contact the person or company you wrote the check to and see if the check has been received. If it hasn’t, the check may have been lost and you may want to call the bank and make a stop payment.

Verify that additional withdrawals listed on your statement, other than checks, are charged for the amount actually drawn. This includes ATM withdrawals, Visa Check Card transactions and any automatic debit transactions like insurance payments, loan and/or utility payments.

Make a list of all outstanding checks or ATM/Visa Check card withdrawals. These are transactions that appear in your checkbook register that do not have a check “P” mark next to them. Add these items together. Tip: Use the worksheet on the back of your statement.

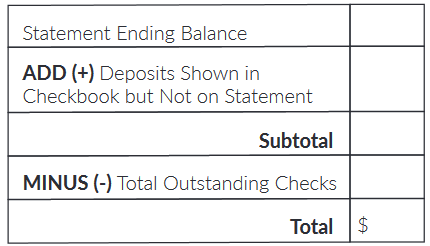

Now, balance your checkbook register to your bank statement. Use the formula below, which is also located on the worksheet on the back of your statement.

Now, balance your checkbook register to your bank statement. Use the formula below, which is also located on the worksheet on the back of your statement.

Compare this total with the ending balance in your checkbook register. They should be the same. If not, there’s a mistake. Do Not Panic! This can be easily fixed. If they are the same Congratulations! You’ve successfully balanced your checkbook.

Well, you’ve tried hard and made every effort. Now it’s time to ask for help. Call or come by one of our branches. You will need to bring in your current bank statement and your checkbook register. Every effort will be made to assist you balancing, and next time it will be easier.